CFIUS and Body Armor: What Foreign Investment Reviews Mean for Defense and Public Safety Companies

Foreign companies continue to show interest in investing in or acquiring stakes in U.S. defense and public safety businesses, including those in the body armor sector. On the surface, this can appear mutually beneficial: foreign capital supports growth, while U.S. technologies and products gain broader markets.

But in practice, such deals trigger national security concerns.

That’s where the Committee on Foreign Investment in the United States (CFIUS) steps in. This interagency body evaluates whether foreign investments pose risks to U.S. security, particularly when the businesses in question develop or supply sensitive technologies, such as ballistic-resistant materials and body armor.

For manufacturers, distributors, and integrators in the armor ecosystem, understanding the CFIUS process isn’t optional; it’s essential. IntelAlytic’s consulting expertise and The Armor List’s comprehensive data platform together provide the clarity needed to navigate these high-stakes transactions. We’ve also created a CFIUS Readiness Checklist for Body Armor Companies—10 key areas to prepare before entering any foreign investment or acquisition.

The Industry Problem: Foreign Investment Meets National Security

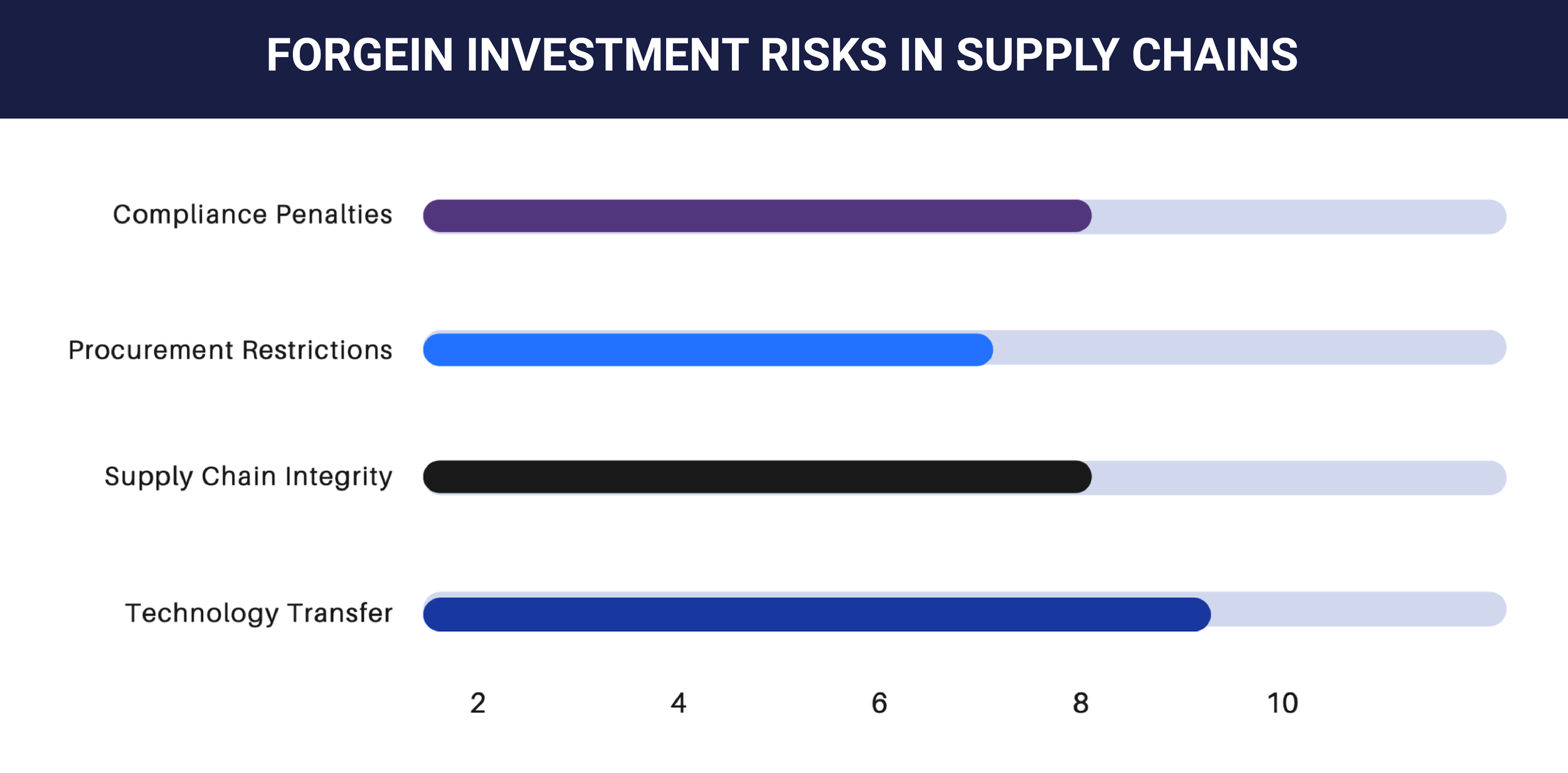

The U.S. body armor industry sits at the intersection of public safety and defense supply chains, meaning foreign ownership raises critical concerns:

Technology transfer risks: Ballistic materials and NIJ-certified designs could be exploited by adversaries.

Supply chain integrity: Control over sourcing, manufacturing, or distribution channels may shift outside U.S. oversight.

Procurement implications: Federal agencies and law enforcement customers may face restrictions or hesitancy when procuring from foreign-controlled companies.

Compliance exposure: Failing to report or secure approval for a covered transaction could lead to divestiture orders, financial penalties, and reputational damage.

In short, a promising acquisition or investment deal can collapse if parties are unprepared for the CFIUS review process.

CFIUS Review Process for Defense Contractors: Why CFIUS Matters

CFIUS reviews aren’t simply about paperwork; they touch nearly every aspect of government contracting and compliance. Here’s what companies in the body armor industry must understand:

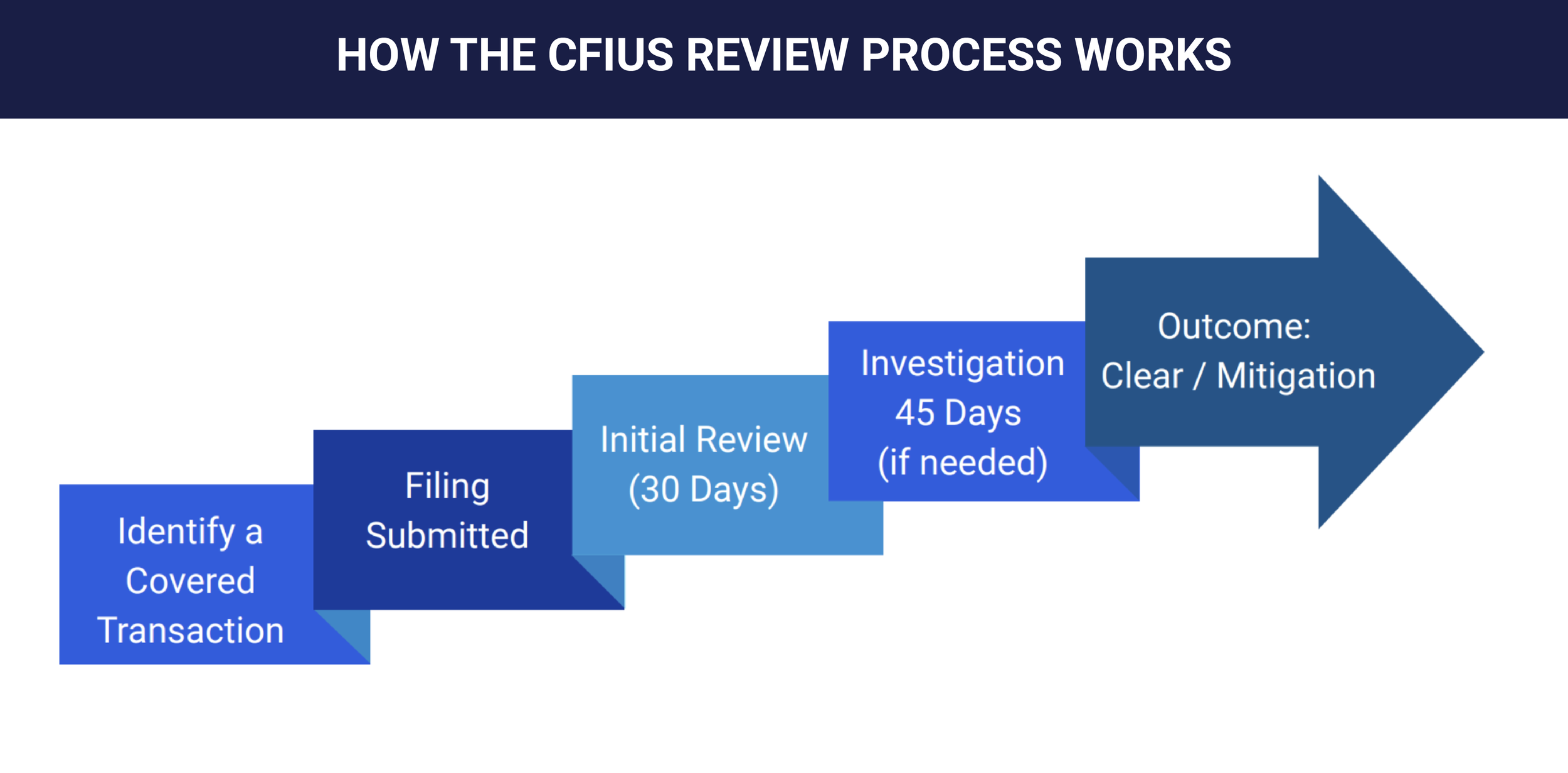

Covered Transactions

Any deal that grants a foreign person control, influence, or access to critical technologies, sensitive personal data, or real estate near military installations may trigger review. For armor companies, NIJ-tested products, ballistic fibers, or DoD-related contracts are often qualifying options.Agencies Involved

The U.S. Department of the Treasury chairs CFIUS, but decisions involve the Departments of Defense, Justice, Homeland Security, Commerce, State, and others; each weighing the implications of foreign access to armor technologies.Due Diligence Requirements

Companies must be able to show documentation of supply chains, export control classifications (ITAR/EAR), contract histories, and compliance systems (ISO 9001, BA 9000, DFARS). IntelAlytic frequently advises clients on preparing this evidentiary foundation.Potential Outcomes

CFIUS may clear the transaction, impose mitigation measures (e.g., limiting foreign access to technical data), or block the deal entirely. In extreme cases, it can order divestment even after a deal has closed.

For executives, legal teams, and investors, the message is clear: CFIUS isn’t a box to check, it’s a strategic gatekeeper.

The Armor List Advantage: Data to Prepare for Review

While IntelAlytic interprets the regulatory environment, The Armor List provides the verified data backbone needed for due diligence and CFIUS preparedness.

Company Profiles: 250,000+ data points across armor manufacturers, distributors, and materials suppliers, including ownership records, contract awards, certifications, and supply chain identifiers (DUNS, CAGE, UEI).

Product Verification: Independent tracking of NIJ-certified models, recalls, advisories, and contract use, all critical when foreign ownership may raise questions about safety or legitimacy.

Comparison Tools: Procurement officers and compliance teams can cross-reference armor specifications with regulatory standards, helping demonstrate transparency during government review.

Risk Mapping: Linking companies to their materials, technologies, and distribution channels gives a clear picture of potential national security sensitivities before regulators demand it.

Together, IntelAlytic and The Armor List help stakeholders anticipate CFIUS concerns before the government does.

Case Example: A Hypothetical Armor Acquisition

Imagine a European investment fund seeking to acquire a controlling stake in a mid-sized U.S. plate manufacturer supplying Level IV armor plates to both state law enforcement and DoD integrators.

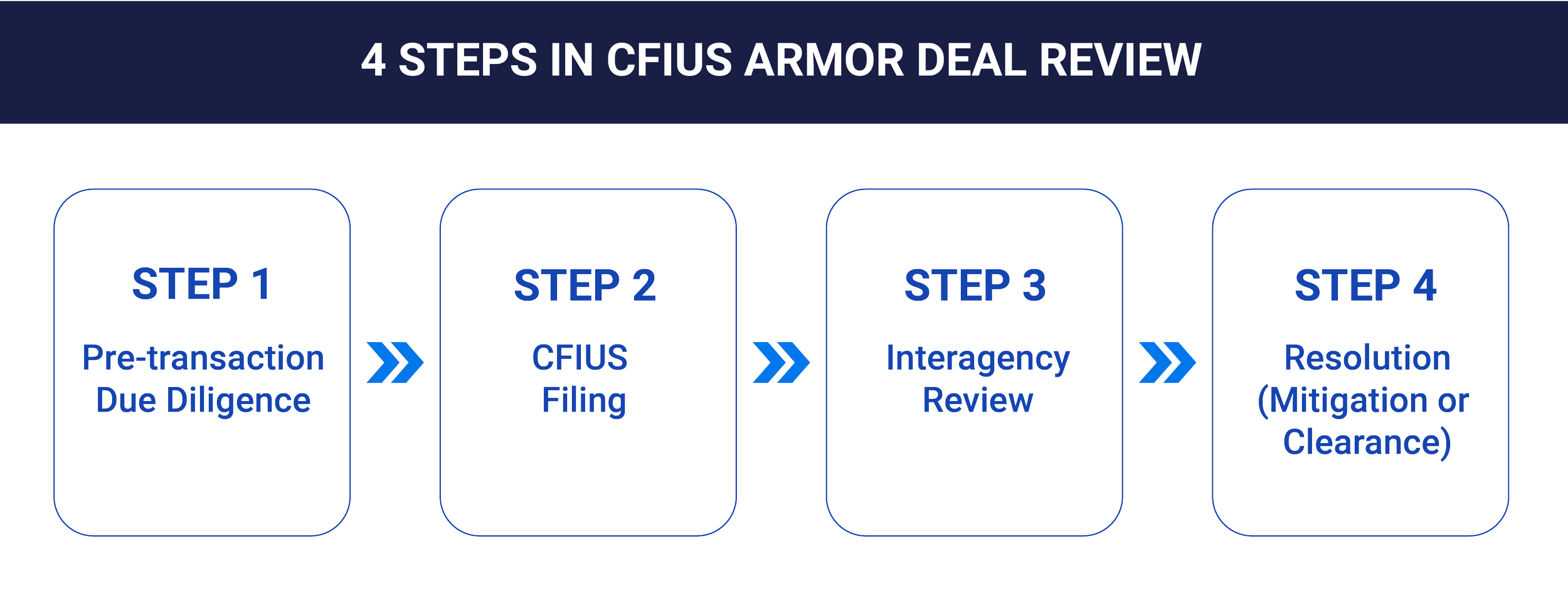

Step 1: Pre-transaction due diligence. IntelAlytic reviews the company’s export classifications, government contract exposure, and ownership structure. The Armor List data confirms NIJ certification status and maps supply chains.

Step 2: CFIUS filing. Parties file a voluntary notice to CFIUS, disclosing the potential national security risks tied to foreign ownership.

Step 3: Interagency review. DoD expresses concern over the transfer of ceramic composite technologies used in sensitive applications. Mitigation measures are negotiated.

Step 4: Resolution. CFIUS clears the transaction with restrictions on access to certain data and contracts, preserving both national security and commercial opportunity.

This example underscores why proactive analysis is critical. Without preparation, the deal could have been blocked outright. One of the key elements for National Security Purposes is driven by Global Investment and Economic Security (GIES).

CFIUS Readiness Checklist for Body Armor Companies

Before entering into any foreign investment or acquisition, companies in the body armor and ballistic protection space should prepare the following:

Ownership & Control Documentation

Export Control Classification

Certifications & Compliance

Government Contracts & Procurement

Supply Chain Mapping

Sensitive Technology & Data Access

Facility & Real Estate Considerations

Governance & Risk Management

Due Diligence Files

Voluntary Notice Preparation

IntelAlytic guides clients through the legal and strategic compliance landscape, while The Armor List supplies verified, contract-linked data across 250,000+ armor products, companies, and suppliers, ensuring no gaps in your CFIUS submission.

Preparing for CFIUS is Preparing for Success

For companies in the body armor ecosystem, foreign investment can open doors to growth, but only if handled with the discipline of compliance and transparency.

CFIUS review is not an obstacle but a reality of doing business in defense and public safety. With IntelAlytic’s advisory services, firms gain the expertise to interpret regulatory frameworks and negotiate with confidence. With The Armor List’s verified database, they gain the evidence base to prove legitimacy, compliance, and transparency.

Want to safeguard your next deal or acquisition?

IntelAlytic’s consulting team and The Armor List platform together provide the tools, insights, and authority to navigate CFIUS and beyond.

Visit armorlist.com or contact support@intelalytic.com to learn how your brand can be featured in front of buyers, agencies, and industry leaders.