Leveraging Tax Opportunities for Bulletproof Manufacturing Growth and Reinvestment

Data obtained from a chart titled 'How High are Corporate Income Tax Rates in Your State,' provided by the Tax Foundation, last updated on January 1, 2023.

Tax season is upon us, and with Tax Day 2024 being one sleep away, companies in the body armor and ballistic protection industry face a period of critical financial decision-making. Specializing in the engineering, manufacturing, testing, and distribution of advanced protective gear, these companies discover a complex tax landscape that offers significant challenges and substantial opportunities. Compliance is essential, but the strategic utilization of tax laws can unlock potential benefits, fueling growth and reinvestment in vital areas such as innovation, safety standards, and production efficiency. Imagine the possibilities of your company's growth and innovation with the right tax planning strategies.

This period is crucial for finalizing this year's tax filings and planning for future fiscal years. It is a time to leverage every possible tax advantage to support and enhance specialized operations. Companies poised to take advantage of these opportunities can substantially improve their market positioning and technological advancement.

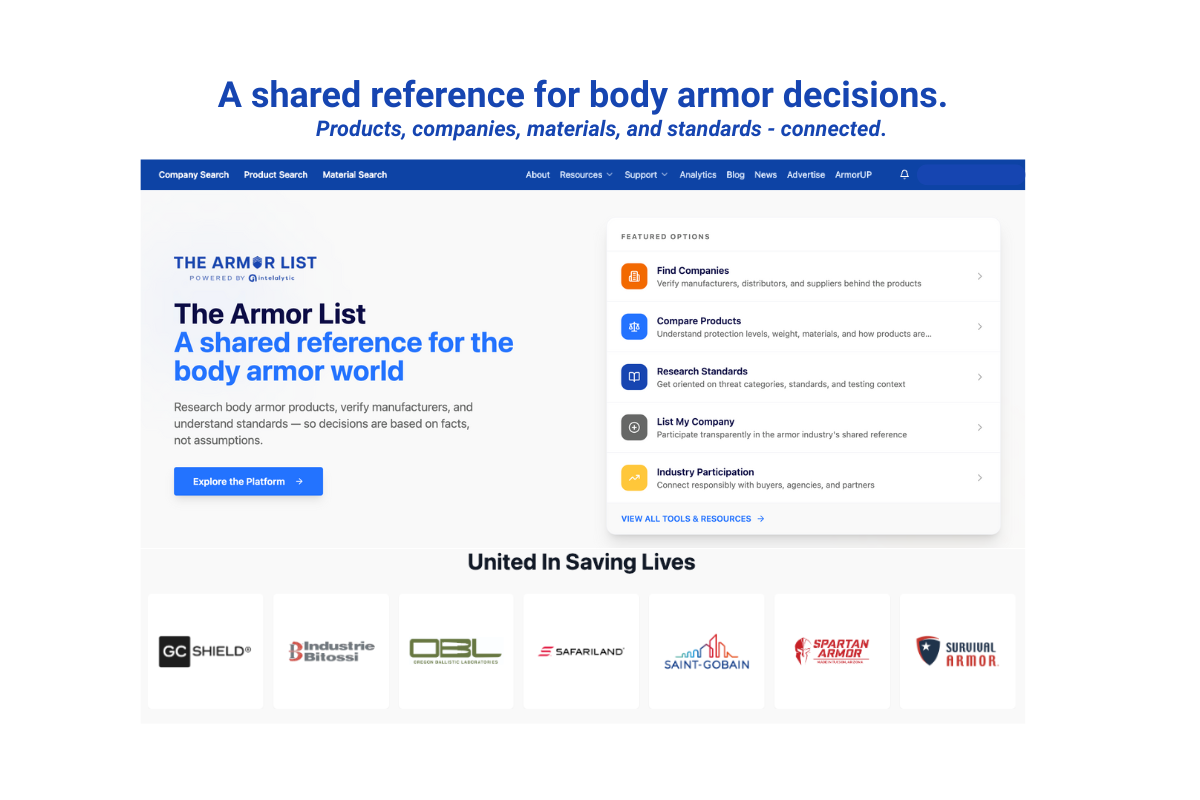

It is beneficial to partner with experts who specialize in the nuanced needs of the defense sector. Team IntelAlytic offers specialized support to organizations in the body armor industry, providing tailored strategies that help maximize tax benefits and reinvestment opportunities. Our goal is to ensure that your company meets its compliance obligations and achieves significant growth and innovation through intelligent tax planning. This guide aims to equip business owners with the necessary insights to leverage tax strategies effectively, ensuring readiness for current and future challenges in the ballistic protection market.

Strategic Tax Planning: A Future-Ready Checklist for Body Armor Manufacturers

Introduction to Strategic Tax Planning

For body armor manufacturers, the intricacies of tax planning go beyond mere compliance; they represent a crucial part of strategic business management. To survive and thrive in the competitive landscape of ballistic protection, companies must fully leverage tax incentives that align with their specialized business needs. A robust, future-ready checklist is not just a tool; it's a strategic asset. It's foundational for capitalizing on these opportunities, ensuring that all potential benefits are optimized to support technological advancements, operational efficiency, and industry compliance. With this checklist, you can feel confident in your readiness for the future.

Detailed Checklist for Strategic Tax Planning

To conquer the upcoming tax season with precision and foresight, body armor manufacturers should consider the following expanded strategic checklist:

1. Review Previous Tax Filings

Conduct a thorough audit of past returns to identify patterns and missed opportunities.

Engage with tax professionals to reassess and refine strategies, focusing on industry-specific deductions and credits that may have been overlooked.

2. Document R&D Activities

Establish a systematic approach for tracking all R&D expenditures, including labor, supplies, and third-party contractor expenses directly tied to research and development.

Maintained detailed logs and technical reports that substantiated the innovation and development of new ballistic materials or enhancements in existing products, ensuring these aligned with the criteria for R&D tax credits.

3. Track Capital Expenditures

Implement a robust asset management system to monitor expenditures on specialized equipment, such as high-tech fiber weavers or advanced ceramic processing machinery.

Schedule periodic reviews to assess the life cycle of existing assets and plan for future investments that can maximize tax benefits under Section 179 or bonus depreciation.

4. Monitor Compliance and Safety Training Programs

Document all training programs, particularly those that address compliance with evolving safety standards in the defense manufacturing sector.

Leverage these records for compliance and as part of a strategic approach to qualify for educational grants or tax deductions to enhance industry-specific skills.

5. Evaluate Hiring Practices

Review and enhance recruitment strategies to target veterans and other key groups integral to the workforce and provide eligibility for the WOTC.

Develop partnerships with local and national veteran organizations to streamline hiring individuals with the critical skills and security clearances beneficial for the defense sector.

6. Assess Environmental Compliance and Energy Efficiency Initiatives

Explore opportunities for tax incentives related to environmental compliance and sustainable manufacturing practices.

Invest in energy-efficient technologies and processes that can lead to significant tax credits, reducing overall operational costs and supporting corporate sustainability goals.

7. Plan for Continuous Improvement and Innovation

Foster a culture of continuous improvement that encourages ongoing assessment and utilization of tax strategies in line with business growth and technological advancements.

Regularly update strategic plans to reflect new tax laws and financial practices that can affect the body armor manufacturing industry.

By adopting this comprehensive, strategic tax planning checklist, body armor manufacturers can ensure they are prepared for the upcoming tax season and positioned to take full advantage of tax-related opportunities. This proactive approach enables companies to reinvest in their core business areas, drive innovation, and maintain a competitive edge in the fast-evolving field of ballistic protection. Engaging deeply with each element of this checklist will provide a structured pathway to achieving compliance and strategic business objectives, ultimately leading to sustained growth and industry leadership.

Tax Credits and Incentives Specific to Ballistic Protection

Overview of Tax Credits and Incentives

For body armor and ballistic protection manufacturers, leveraging tax credits and incentives is a strategic necessity, not merely a financial convenience. These benefits foster innovation and sustainability, crucial elements in an industry focused on advancing safety and protective technologies. Understanding and utilizing these incentives can significantly reduce tax liabilities while supporting essential research and development R&D and environmental initiatives.

Detailed Examination of Relevant Tax Credits and Incentives

1. Research & Development R&D Tax Credit

Scope and Impact: This credit is indispensable for manufacturers dedicated to pushing the boundaries of materials science and ballistic resistance technology. It directly offsets the cost of developing new or significantly improved body armor products, including advanced fibers, ceramics, and composite materials.

Eligibility and Documentation: To maximize this credit, companies must meticulously document their R&D activities, showing a clear connection between the expenses incurred and the R&D efforts. This includes detailed records of experimental designs, prototype testing, and results analysis.

Strategic Utilization: Engage with R&D tax credit specialists to identify and claim all qualifying activities and expenditures. This could involve everything from raw material experimentation to software development for product design.

2. Energy Efficiency Credits

Significance in the Industry: Body armor manufacturing is typically energy-intensive, involving high-temperature processes and specialized machinery. Energy efficiency credits are designed to offset some of the costs associated with implementing greener technologies that reduce these operations' energy consumption and carbon footprint.

Qualifying Investments might include upgrading to more energy-efficient furnaces for material treatment, implementing advanced HVAC systems in extensive manufacturing facilities, or adopting energy-efficient lighting and motor systems.

Maximizing Benefits: To capitalize on these credits, companies should conduct energy audits to identify potential areas for improvement and invest in technologies that reduce energy consumption and qualify for these lucrative tax credits. Documentation of savings and efficiency improvements is critical for substantiating claims.

3. Advanced Manufacturing and Technology Investment Credits

Purpose and Benefits: Recognizing the need for continual advancement in manufacturing technologies, some jurisdictions offer credits for investments in advanced equipment and technology to improve product quality and production efficiency.

Eligible Equipment: This may include high-precision CNC machinery, robotics for body armor assembly and testing, and systems for digital and automated quality control.

Leveraging the Credits: Manufacturers should plan equipment upgrades and technology investments in line with these credits, consulting with tax professionals to ensure eligibility and compliance with local and federal tax laws.

4. Safety Compliance Credits

Industry Relevance: Given the stringent safety standards required in body armor manufacturing, credits to enhance workplace safety can be particularly beneficial.

Qualifying Activities: These credits may cover investments in safety equipment, training programs, and compliance certifications that exceed basic legal requirements.

Strategic Approaches: Review safety protocols and training programs regularly to identify areas where investments enhance safety and qualify for these credits.

By understanding these tax incentives and compliance, companies within the body armor sector can significantly bolster their innovation capabilities and environmental stewardship while mitigating tax liabilities. Each credit or incentive offers a unique opportunity to support the industry’s push toward more advanced, sustainable, and adequate protective solutions. Manufacturers are encouraged to regularly consult with tax experts who specialize in these areas to ensure they capture the full scope of benefits, thereby securing both financial advantage and technological advancement.

Depreciation and Investment in Advanced Equipment

Overview of Depreciation Benefits

For manufacturers in the body armor sector, staying technologically advanced is not just about leading the market—it's also about leveraging tax policies that support substantial investments in high-tech equipment. Depreciation tax benefits such as Section 179 deductions and bonus depreciation are vital tools that can help offset the high costs of acquiring and upgrading sophisticated manufacturing technologies.

Detailed Insights into Key Depreciation Advantages

1. Section 179 Deduction

Strategic Impact: This provision allows companies to deduct the total purchase price of qualifying equipment from their gross income during the same tax year. For body armor manufacturers, this can include acquiring advanced machinery used to produce next-generation materials and products.

Qualifying Equipment: Examples include advanced weaving machines for synthetic fibers crucial for lightweight, durable body armor and high-pressure presses for forming ceramic plates for ballistic protection.

Maximizing the Deduction: To fully benefit from Section 179, manufacturers must plan their equipment purchases strategically throughout the year and ensure that all acquisitions meet the specific requirements set forth by the tax code. Proper documentation and timely purchasing decisions are crucial to maximize these deductions.

2. Bonus Depreciation

Accelerated Benefits: Bonus depreciation is particularly beneficial for body armor manufacturers looking to quickly expand their production capabilities or upgrade their facilities with the latest technologies. This incentive allows businesses to depreciate a significant portion of the purchase price of new equipment beyond the standard depreciation schedules.

Scope of Application: This can be applied to investments such as new testing facilities equipped with state-of-the-art ballistic testing tools or expanding existing plants to increase production capacity. It also applies to upgrades incorporating robotic assembly lines or enhanced quality control systems.

Strategic Application: Leveraging bonus depreciation requires understanding the eligible property types and the timing of acquisitions. Manufacturers should work closely with tax professionals to plan these investments around tax benefit schedules to optimize cash flows and minimize taxable income.

3. Customized Depreciation Strategies

Tailored Approaches: Beyond standard depreciation methods, manufacturers can consider customized depreciation strategies that align with their specific operational cycles and financial planning needs. This may involve a cost segregation study to accelerate depreciation on specific manufacturing facility components.

Benefits of Customization: These tailored strategies can lead to significant tax savings, providing more immediate returns on investment, which can be reinvested into the business to fuel further innovation and growth.

4. Planning for Future Investments

Forecasting Needs: Effective depreciation planning addresses fiscal advantages and anticipates future technological and market developments. Manufacturers should continuously evaluate their equipment and technology needs against evolving industry standards and customer expectations.

Integrating Tax Planning with Business Strategy: Integrating depreciation strategies into broader business planning ensures that every investment advance technological capability and maximizes financial benefits through tax savings.

The strategic use of depreciation mechanisms like Section 179 deductions and bonus depreciation allows body armor manufacturers to significantly reduce the financial burdens of purchasing advanced equipment. Companies can enhance their technological capabilities by effectively planning and documenting these investments while optimizing their tax positions. This approach supports immediate operational needs and positions manufacturers for long-term success in a highly competitive industry. Manufacturers are advised to regularly consult with tax experts to stay abreast of the latest tax laws and ensure compliance and optimization of these valuable tax benefits.

Work Opportunity Tax Credit WOTC and Defense Sector Employment

Overview of the Work Opportunity Tax Credit

The Work Opportunity Tax Credit WOTC is a critical incentive for employers in the defense sector, particularly manufacturers of body armor and ballistic protection. This tax credit encourages hiring individuals from specific target groups who may face significant barriers to employment, including veterans. In the defense industry, veterans are highly valued for their expertise, experience, and unique insights into the practical applications of ballistic protection products.

Critical Benefits of WOTC for Body Armor Manufacturers

Target Group Focus: Veterans are among the primary beneficiaries of the WOTC, making them an ideal hiring focus for companies in the defense sector. Their skills in tactical knowledge, security, and operations management directly contribute to manufacturing, testing, and enhancing body armor products.

Financial Incentives: Employing individuals from WOTC target groups can provide employers a tax credit of up to $9,600 per eligible employee. This significant financial benefit helps reduce the company's overall tax liability, making investments in new hires more feasible and financially attractive.

Strategic Hiring Practices: Leveraging the WOTC encourages strategic hiring practices. Companies can align their recruitment strategies to fill essential roles within their operations and capitalize on the tax benefits offered, enhancing overall profitability and workforce stability.

Implementing WOTC in Strategic Hiring

Recruitment Planning: Develop a targeted recruitment plan that prioritizes veterans and other WOTC-eligible individuals. This plan should include partnerships with local veterans' associations, career fairs, and military transition programs.

Documentation and Compliance: Ensure proper documentation and adherence to the WOTC's eligibility requirements. This includes maintaining detailed records of the hiring process and each hire's qualifications to substantiate the claim for tax credits.

Ongoing Training and Integration: Invest in training programs that enhance the skills of newly hired veterans and integrate their military experience into the civilian manufacturing environment. This optimizes the employee's contribution to the company and maximizes the return on investment for each WOTC hire.

Conclusion

The Work Opportunity Tax Credit is a powerful tool for body armor manufacturers, especially in a sector that highly values veterans' skills and experiences. By incorporating WOTC into their hiring strategies, companies can achieve a dual benefit: They support workforce diversity and inclusion while gaining financial incentives that bolster their operational capabilities and economic efficiency.

Training and Development Incentives in Ballistic Protection

Overview of Training and Development Incentives

Training is not merely an operational necessity for manufacturers in the body armor and ballistic protection industry; it is a strategic investment. High training standards ensure that the workforce can meet the rigorous demands of body armor production, which include precision manufacturing, adherence to safety standards, and continuous innovation.

Key Aspects of Training Incentives

Enhancing Workforce Capabilities: Advanced training programs help employees master the complex techniques required to produce high-quality ballistic protection gear. This includes handling new materials, operating advanced machinery, and adhering to strict quality control procedures.

Compliance with Industry Standards: The ballistic protection industry is governed by stringent regulatory standards that ensure the safety and effectiveness of body armor. Regular training helps ensure that all employees are up to date on these standards, which can evolve as new threats and technologies emerge.

Tax Benefits of Training: Investing in employee training can often qualify for tax deductions, reducing the net cost of these initiatives. For instance, these deductions can offset costs associated with developing and delivering training programs, making them a cost-effective way to enhance employee skills and productivity.

Strategic Implementation of Training Programs

Tailored Training Solutions: Develop training programs specifically tailored to the needs of the ballistic protection industry. This could involve specialized courses in materials science, ballistic testing methods, and the application of new manufacturing technologies.

Leveraging Government Grants and Subsidies: Explore opportunities to leverage government grants and subsidies designed to support training in high-tech industries. These funds can significantly reduce the financial burden associated with comprehensive training programs.

Continuous Learning and Development: Establish a culture of continuous learning within the organization. This will help maintain a highly skilled workforce and ensure the company can swiftly adapt to new challenges and technological advancements.

Conclusion

Training and development are crucial for maintaining a competitive edge in the ballistic protection industry. By investing in comprehensive training programs and taking advantage of the available incentives, manufacturers can enhance their workforce's capabilities, ensure compliance with industry standards, and improve overall productivity and innovation. This strategic focus on training bolsters internal operations and positions the company as a leader in a highly specialized and demanding market.

Reinvestment Strategies for Sustainable Growth in Ballistic Protection

Overview of Reinvestment Strategies

In the body armor and ballistic protection industry, strategic reinvestment of tax savings is crucial for maintaining a competitive edge and driving sustainable growth. Effective reinvestment strategies can amplify the impact of tax benefits, turning temporary financial gains into long-term business successes.

Key Reinvestment Approaches

1. Research and Development R&D

Continuous Innovation: In an industry that relies on technological advancements for improved safety and performance, continuous investment in R&D is essential. These investments fuel the development of new materials and technologies that can lead to more effective and lighter body armor solutions.

Strategic Focus: Focus R&D efforts on emerging threats and integrating new scientific findings into product designs. This proactive approach ensures that the company stays ahead of industry trends and regulatory changes.

Leverage R&D Tax Credits: Maximize the return on R&D investments by taking full advantage of available R&D tax credits, which can significantly offset the costs associated with experimental development and testing.

2. Upgrading Production Facilities

Advanced Manufacturing Technologies: Invest in the latest manufacturing technologies to enhance production efficiency and product quality. These include automation, precision engineering, and advanced materials handling systems.

Eco-Friendly Solutions: Consider implementing sustainable manufacturing practices that reduce environmental impact and may qualify for additional tax incentives.

Cost-Benefit Analysis: Conduct regular cost-benefit analyses to determine the optimal time and scale for facility upgrades, ensuring each investment delivers the best possible return.

3. Employee Benefits and Retention Programs

Competitive Benefits Packages: Enhance employee benefits to improve job satisfaction and retention rates, particularly for skilled workers, crucial in high-stakes production environments. This could include health care, retirement plans, and performance-based bonuses.

Skill Development and Career Advancement: Invest in training and development programs that offer career advancement opportunities within the company. This helps retain top talent and ensures a highly skilled workforce capable of handling advanced production techniques and innovation.

Work Environment Enhancements: Improve the work environment by focusing on safety, ergonomics, and employee well-being. A positive work environment enhances productivity and helps maintain a motivated workforce.

Conclusion

Reinvestment strategies in the body armor sector should be thoughtfully planned and aligned with the company’s long-term objectives. Manufacturers can ensure sustainable growth and continued leadership in the defense industry by strategically reinvesting tax savings into R&D, advanced production facilities, and comprehensive employee benefits. These strategies not only leverage the immediate financial benefits of tax savings but also pave the way for future innovations and improvements, securing the company’s position in a highly competitive market.

Planning for Future Tax Advantages in Body Armor Manufacturing

Overview of Future Tax Planning

Effective tax planning is a cornerstone of strategic management in the body armor manufacturing industry. As the current tax year concludes, it is imperative for manufacturers to not only assess past activities but also to prepare for future developments. This involves a proactive approach to understanding legislative changes, optimizing tax positions, and aligning business strategies with evolving tax opportunities.

Detailed Strategies for Future Tax Planning

1. Engage with Tax Professionals

Regular Consultations: Establish ongoing relationships with tax professionals specializing in manufacturing and defense sector taxation. These experts are invaluable for comprehending complex tax landscapes and can provide insights that align with industry-specific challenges and opportunities.

Proactive Tax Management: Work closely with these advisors to anticipate changes in tax laws and adjust strategies accordingly. This may involve restructuring investments, revising depreciation schedules, or discovering new tax credits and incentives as they become available.

Audit and Compliance Preparation: Utilize tax professionals to ensure all filings comply with current laws and prepare for potential audits. This reduces risk and enhances confidence in financial reporting.

2. Participate in Industry-Specific Workshops

Continued Education: Regularly attend workshops, seminars, and conferences on the latest defense manufacturing and tax legislation developments. These events are crucial for staying informed about new technologies, regulatory changes, and emerging market trends.

Networking Opportunities: Use these gatherings to network with peers, tax experts, and industry leaders. Networking can provide additional insights and strategies for effectively managing tax obligations and maximizing benefits.

Applying Learned Strategies: Implement the best practices and strategies learned from these workshops to enhance the company’s tax planning and overall business strategy.

3. Monitor Legislative Changes

Legislative Tracking: Monitor legislative developments that could impact the defense manufacturing sector, especially those related to tax policies. This includes tracking state and federal legislation affecting how body armor products are taxed or which investments might qualify for tax incentives.

Adaptive Strategies: Be prepared to quickly adapt business and tax strategies in response to new legislation. This agility can provide a competitive advantage by enabling the company to take early action on industry changes.

Advocacy and Influence: Where possible, participate in advocacy efforts to shape legislation that affects the body armor industry. A voice in the legislative process can help steer decisions favorable to the industry.

Conclusion

Planning for future tax advantages requires proactive strategy, ongoing education, and expert consultation. For body armor manufacturers, staying ahead in a rapidly evolving industry means keeping abreast of current tax laws, anticipating future changes, and preparing to adapt swiftly. By engaging in continuous learning and building strong relationships with tax professionals and industry leaders, companies can enhance their readiness for future challenges and opportunities, ensuring they maintain a strong and sustainable competitive edge.

For companies in the body armor and ballistic protection industry, adept management of tax incentives can transform the tax season from a burdensome obligation into a significant opportunity for strategic business enhancement. By understanding and effectively leveraging these tax opportunities, companies can invest intelligently in research and development, advanced equipment, and skilled personnel, reinforcing their growth, stability, and capacity for innovation.

As we look to the future, these companies must adopt a forward-thinking approach to tax planning. Doing so will maximize their potential tax benefits and ensure they are well-placed to respond to technological advancements and market demands. This strategic orientation is essential for maintaining a competitive edge and securing a leading position in the rapidly evolving defense sector.

To achieve these goals, companies should consider partnering with experts who specialize in knowing the complex tax landscape of the defense manufacturing industry. Team IntelAlytic stands ready to support organizations in maximizing these strategies and future tax benefits. With our tailored guidance and expert insights, we can help your company leverage the specific tax strategies discussed in this guide to foster significant business growth and innovation.

This comprehensive guide has provided crucial insights tailored to the unique needs of the ballistic protection industry. By focusing on industry-specific tax credits, incentives, and strategic reinvestment, businesses are better equipped to overcome the complexities of tax planning and achieve long-term success. We invite you to contact IntelAlytic to explore how we can support your efforts to capitalize on these opportunities and drive your organization's advancement in the defense sector.

Resources

Internal Revenue Service IRS: The IRS provides detailed information on various tax credits and deductions available to U.S. businesses, including the Work Opportunity Tax Credit WOTC guidelines for R&D tax credits.

U.S. Department of Energy DOE: The DOE offers resources and information on energy efficiency credits for businesses investing in sustainable practices.

Database of State Incentives for Renewables & Efficiency DSIRE: DSIRE is the most comprehensive source of information on incentives and policies that support renewable energy and energy efficiency in the United States. Established in 1995, DSIRE is operated by the N.C. Clean Energy Technology Center at N.C. State University.

U.S. Small Business Administration SBA: The SBA provides a range of tools and guides for small businesses, including planning for taxes and leveraging various business deductions and credits.

National Institute of Standards and Technology NIST: NIST offers guidance and resources for manufacturing companies in the defense sector, focusing on compliance and technological advancements.

Tax Foundation: The Tax Foundation provides research and reports on U.S. tax policies, including detailed analyses of how tax laws affect different sectors, including manufacturing.

Manufacturing.net: An industry publication that offers news and articles on various aspects of manufacturing, including tax issues and industry-specific challenges.

Association of the United States Army AUSA: AUSA provides resources and support for Army professionals and has materials useful for defense contractors and manufacturers.

Defense Industry Daily: An online publication that covers developments, contracts, and policies in the defense sector, which can be helpful in strategic planning and understanding market dynamics.

Professional Associations such as NDIA National Defense Industrial Association: NDIA offers various resources, networking opportunities, and detailed industry reports that can aid defense manufacturers in understanding and navigating the complex landscape of defense sector requirements and tax incentives.

These resources provide a broad spectrum of information to help your readers deepen their understanding of tax laws, sector-specific challenges, and opportunities for strategic business growth in the defense manufacturing industry.