The Operating Reality for Small U.S. Body Armor Manufacturers Entering 2026

Entering 2026 With Fewer Unknowns

As small and mid-sized U.S. body armor manufacturers enter 2026, the operating environment is clearer, but also less forgiving, than it was just a few years ago. Rising costs, crowded markets, and unresolved regulatory transitions are no longer temporary issues. They are now part of the baseline reality of doing business.

The U.S. body armor market remains active and meaningful, commonly estimated in the $700–$900 million annual range, depending on how segments are defined. Law enforcement, defense-adjacent buyers, private security, and civilian customers all continue to purchase armor. Demand has not disappeared.

What has changed is the room for error.

Manufacturers can no longer rely on assumptions that costs will fall back to prior levels, that misleading competitors will fade out on their own, or that compliance ambiguity can be managed informally. Advisory firms like IntelAlytic, which focus on armor compliance, procurement, and risk analysis, have consistently noted that manufacturers entering 2026 are operating in a market where discipline, verification, and operational maturity matter more than speed or volume.

This article explains what that environment looks like today, why it exists, and how disciplined manufacturers are positioning themselves to remain viable.

Cost Pressure Is No Longer Temporary

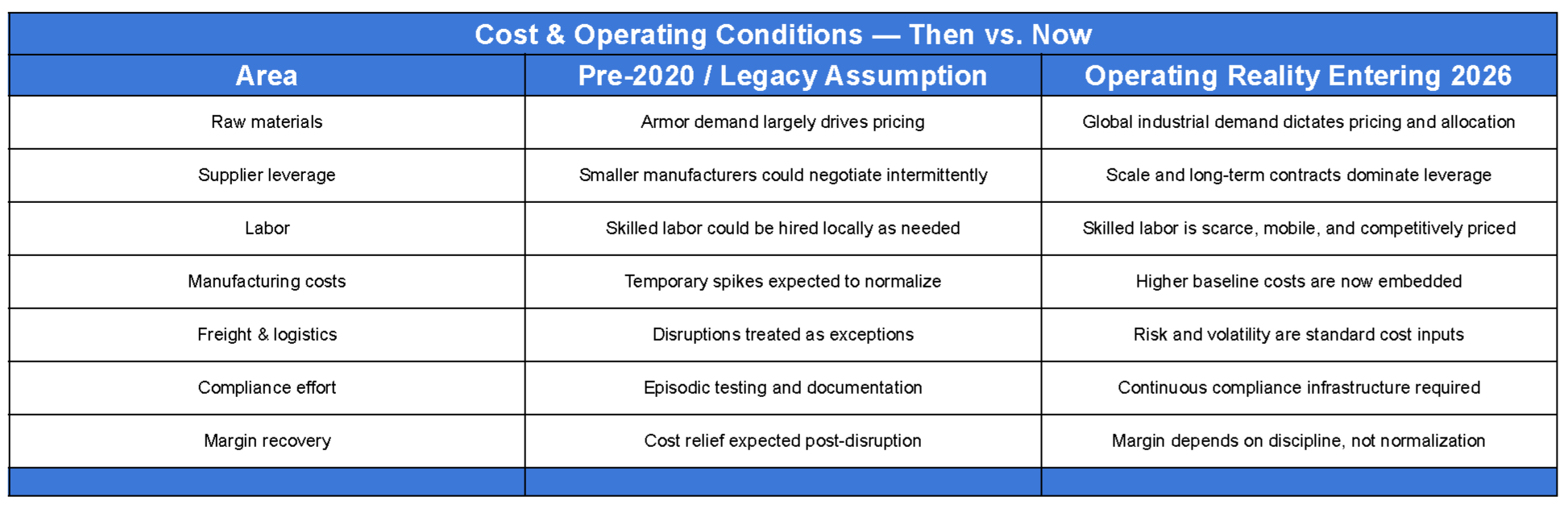

Table 1: Cost & Operating Conditions — Then vs. Now by IntelAlytic

Why Costs Are Not “Going Back to Normal”

Many manufacturers once assumed that high costs were a short-term problem caused by supply chain disruptions or inflation spikes. That assumption no longer holds.

Entering 2026, higher costs are built into the system, across materials, labor, logistics, and compliance. Planning for a return to older cost structures now creates risk rather than resilience.

Materials: Competing With Bigger Industries

Key ballistic materials such as UHMWPE and aramid fibers are used far beyond body armor. Aerospace, automotive, industrial safety, and infrastructure projects compete for the same materials.

For small armor manufacturers, this means:

Less leverage with suppliers

Longer and less predictable lead times

Exposure to price increases that they cannot control

Greater risk when material substitutions are poorly documented

Even when prices fluctuate, supplier power does not reset. This is a scale issue, not a short-term disruption.

Labor: Skilled Work Is Hard to Replace

Body armor manufacturing depends on skilled labor for lamination, ceramic handling, inspection, and documentation. These steps cannot be easily automated without risking quality or compliance problems.

Skilled manufacturing labor remains tight across the U.S., especially in defense-adjacent work. Competition from aerospace and medical manufacturing keeps wages elevated and hiring difficult.

For small manufacturers, labor pressure often shows up as:

Increased scrap and rework

Missed delivery dates

Audit findings tied to inconsistent processes

Labor is no longer a flexible cost. It is a hard limit.

Logistics and Compliance Costs Add Up

Freight volatility, insurance costs, and geopolitical risks are now part of normal landed cost calculations. These costs often erode margins after pricing decisions are already locked in.

Compliance costs, NIJ testing, documentation control, audits, and corrective actions do not scale well for smaller production volumes. During regulatory transitions, these costs usually increase, not decrease.

The key takeaway: costs entering 2026 should be treated as fixed realities, not temporary distortions.

Market Saturation and the Ongoing Noise Problem

A Crowded Market That Has Not Cleaned Itself Up

The body armor market remains crowded. Many new “brands” are not manufacturers at all, but resellers, private-label sellers, or drop-ship operations, especially in civilian and private security channels.

These sellers often:

Carry little inventory risk

Avoid full testing and audit costs

Rely heavily on marketing language

Manufacturers who invest in U.S. labor, testing, and compliance are competing on an uneven playing field that has not corrected itself on its own.

When Buyers Default to Price

In markets where verification is weak, buyers often use price as a shortcut for value. This is dangerous in life-safety equipment, where performance and compliance matter more than appearance.

Misuse of NIJ language remains common. Vague phrases like “tested to” or implied compliance confuse buyers and penalize manufacturers who communicate carefully and accurately.

Verification tools matter here. Platforms like The Armor List, which centralize product and compliance information, help buyers confirm claims and reduce confusion, especially in professional procurement.

NIJ 0101.07: Still a Transition, Not a Finish Line

Entering 2026, NIJ Standard 0101.07 is still in transition.

Manufacturers may have lab test reports, but until a product appears on an official NIJ Compliant Products List (CPL), it cannot be claimed as compliant or marked with the NIJ symbol. This remains true across multiple armor categories.

What this means in practice:

Marketing language is under closer scrutiny

Buyers are asking more detailed questions

Procurement teams are cautious about unverified claims

New HG and RF threat categories were meant to improve clarity, but non-standard labels and comparisons continue to muddy the waters.

IntelAlytic and similar advisory groups consistently recommend strict separation between lab testing results, NIJ compliance status, and marketing claims, especially when bidding or selling to institutional buyers.

Manufacturers entering 2026 should plan for continued transition, not assume quick regulatory closure.

Internal Systems Are the Real Differentiator

External pressure doesn’t usually cause failure; it reveals weaknesses that already exist.

Manufacturers struggling today often face internal limits such as:

Undocumented processes

Compliance handled reactively

Poor change control

Overreliance on a few key people

Audit findings and corrective actions frequently trace back to system gaps, not product design.

Manufacturers that hold up under pressure tend to invest early in:

Quality management systems

Clear documentation ownership

Training and process consistency

Audit readiness as an everyday condition

These investments are not exciting, but they are stabilizing.

How Disciplined Manufacturers Compete in 2026

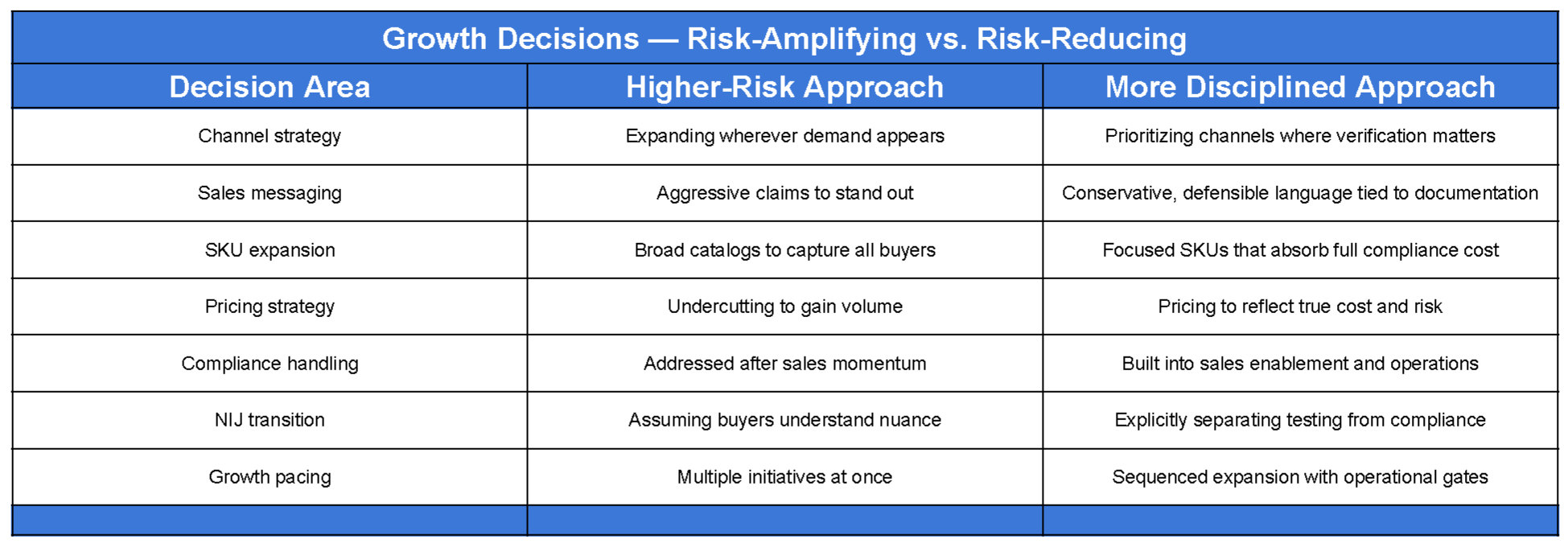

Successful manufacturers are making a clear choice: they stop competing where verification doesn’t matter.

Instead, they:

Focus on institutional and professional buyers

Reduce SKUs that cannot carry full compliance costs

Price products to reflect real costs, even if volume drops

Treat compliance as infrastructure, not a one-time task

This approach filters out risky demand and attracts buyers who value documentation, traceability, and reliability.

IntelAlytic’s work across compliance and procurement consistently shows that in constrained markets, credibility outperforms speed and hype.

Table 2: Growth Decisions — Risk-Amplifying vs. Risk-Reducing by IntelAlytic

Executive Conclusion

Small U.S. body armor manufacturers entering 2026 face an environment shaped by higher costs, persistent market noise, and unresolved regulatory transition. These conditions are not temporary, and they disproportionately affect smaller manufacturers operating without the scale or buffers of larger competitors. Companies relying on informal systems, imprecise compliance language, or outdated assumptions are increasingly exposed as scrutiny rises across procurement and sourcing channels.

Manufacturers that remain viable are those investing in disciplined operations, clear compliance practices, and claims that can be independently verified. In practice, this often requires an external perspective and infrastructure, whether through professional advisory support that helps align operations with regulatory and procurement reality, or through trusted data platforms that allow buyers to validate products, companies, and compliance status without ambiguity.

In today’s market, credibility is no longer optional. It must be designed, documented, and supported because credibility has become the primary competitive advantage.

IntelAlytic’s advisory work and The Armor List’s verification tools exist specifically to support this shift, from claims-based competition to credibility-based decision-making.

Free Download →IntelAlytic Advisory Note: Translating 2026 Market Reality Into Executable Sales and Growth Discipline