The Armor List: A Practical Guide to Thinking Clearly About Body Armor Decisions

Body armor decisions are rarely simple—and the information needed to make them is often scattered. This guide explains how professionals actually use The Armor List to research products, verify manufacturers, understand standards, and make defensible decisions across procurement, use, and lifecycle.

The Operating Reality for Small U.S. Body Armor Manufacturers Entering 2026

As small and mid-sized U.S. body armor manufacturers enter 2026, the market is clearer and less forgiving. Costs remain elevated, regulatory transitions are unresolved, and market noise has not corrected itself. This analysis explains why these pressures are now structural rather than temporary, and how disciplined manufacturers are responding through verification, compliance maturity, and operational rigor.

Milipol Paris 2025: The Golden Circle Roadmap – How Global Body Armor Manufacturers Can Responsibly Support U.S. Procurement Through Smart Distribution, Standards Alignment, and Supply Chain Strength

The U.S. body armor market increasingly depends on global raw materials and manufacturing from Europe, Asia, and APAC—including aramid fibers, UHMWPE composites, laminates, carrier textiles, and international finishing capabilities. As NIJ 0101.07 testing expands and domestic capacity tightens, qualified international manufacturers aligned with NIJ, VPAM, CAST, and STANAG standards can help fill urgent procurement gaps while maintaining compliance and supply chain transparency.

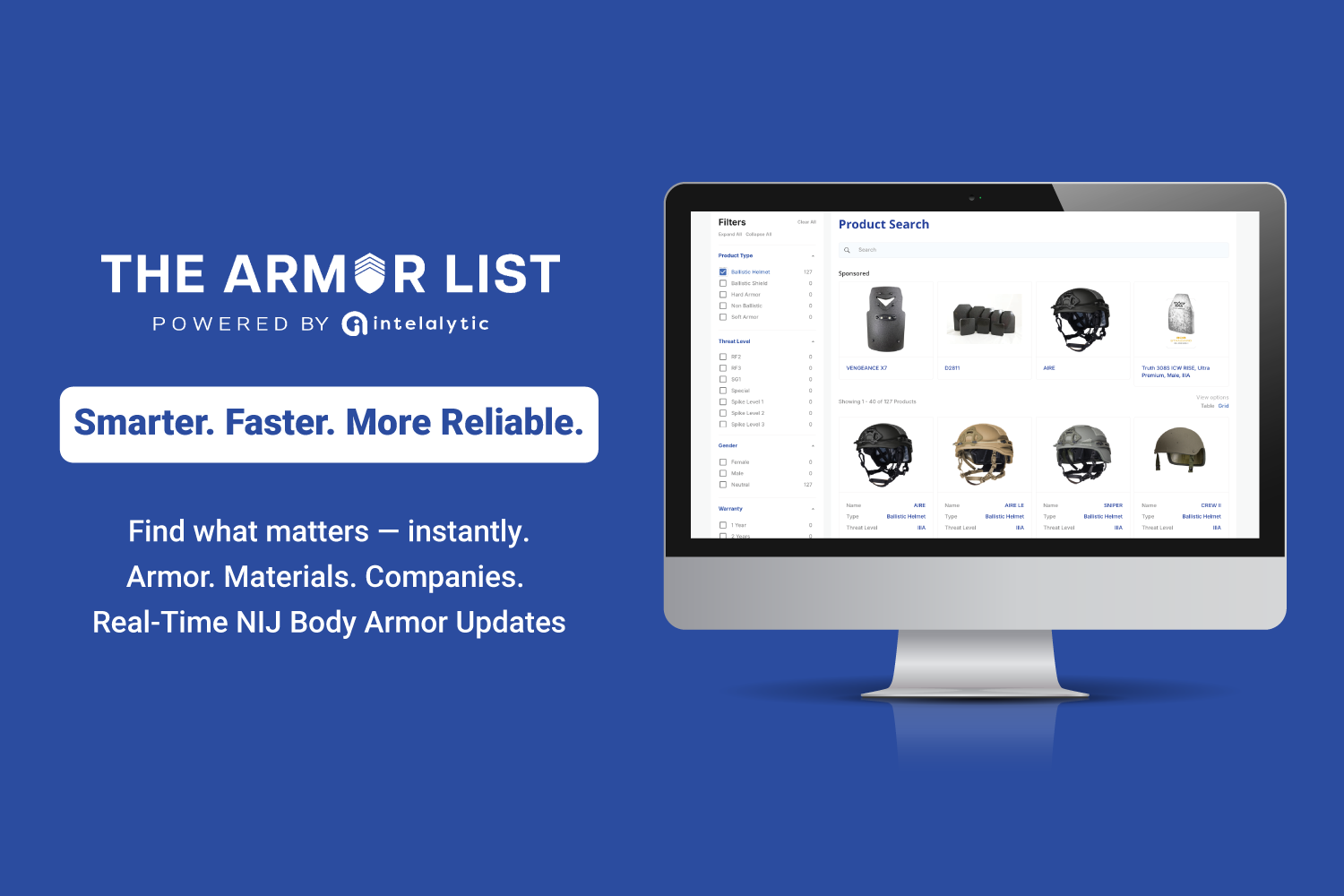

The Armor List: Smarter Data, Faster Performance, and Real-Time NIJ Body Armor Updates

The Armor List, powered by IntelAlytic, continues to evolve as the trusted data platform for the law enforcement and armor community. The latest update brings faster performance, smarter search, and real-time NIJ certification integration — ensuring agencies, procurement teams, and manufacturers always have verified, current, and actionable armor data at their fingertips.